Table of Contents

- Private and Public Sectors

- Profit-based Organizations

- For Profit Social Enterprises

- Non-Profit Social Enterprises

- Factors That Affect The Choice of Legal Status

- Simple Review Questions

- Past Paper Review Questions

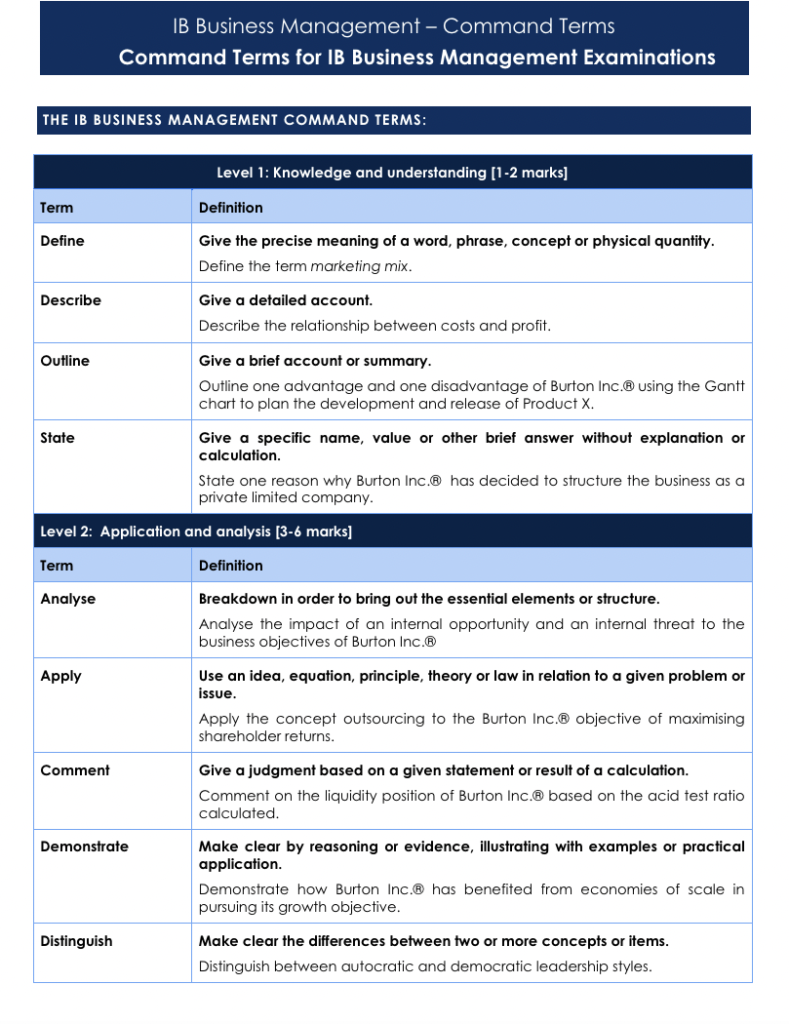

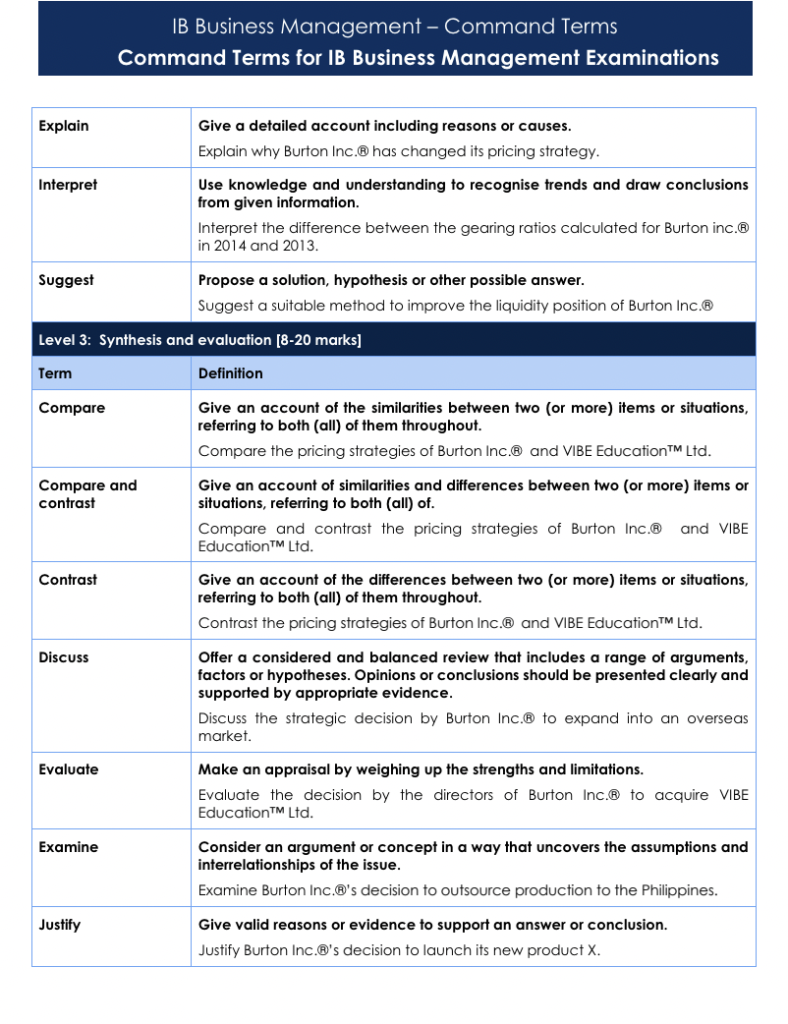

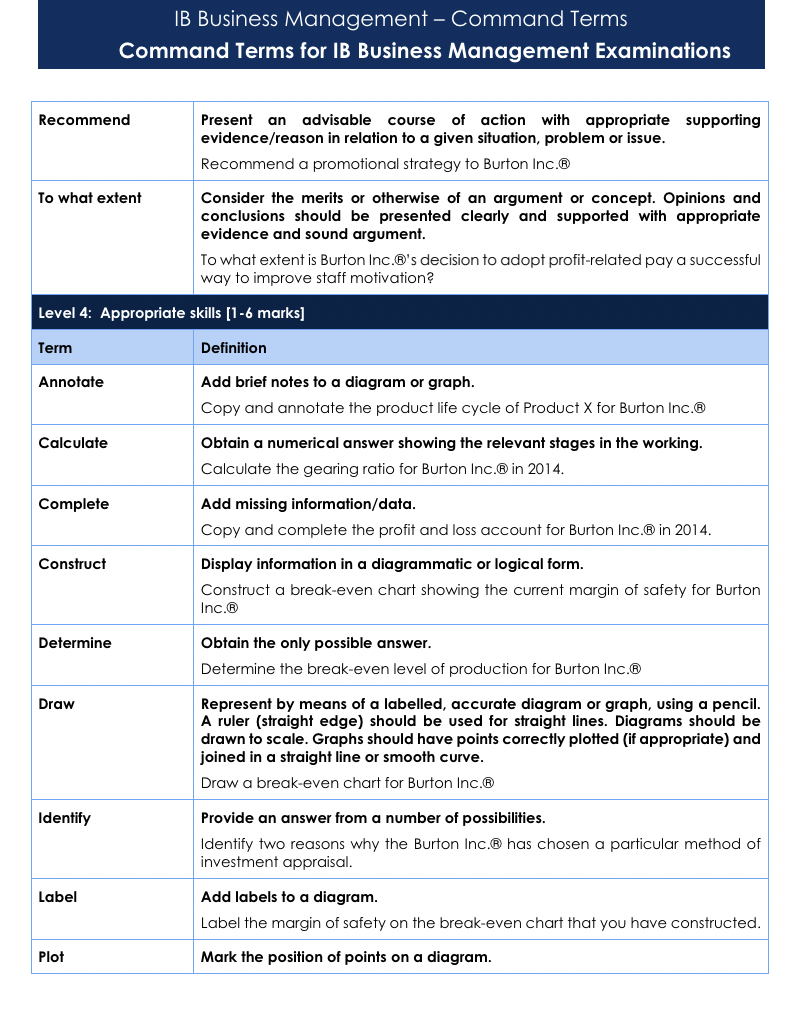

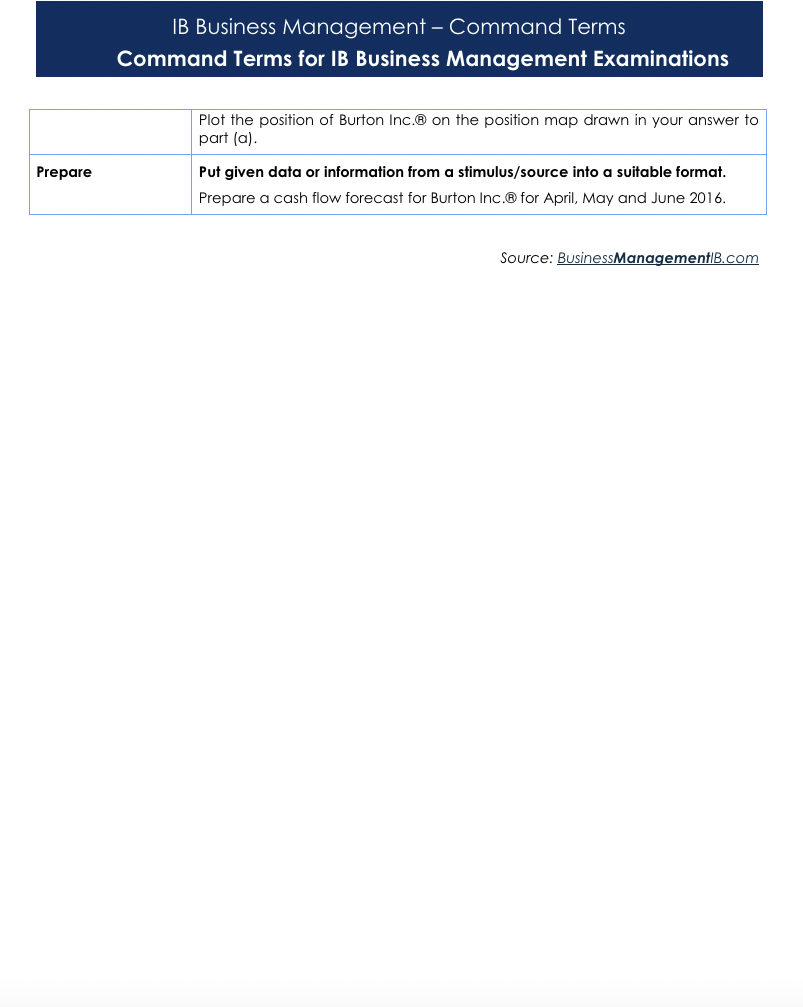

- Command Terms

- References

- Click Here To Learn About Unit 1.4:

Private and Public Sectors

| Private Sector | – Owned and controlled by private individuals and firms – Range of size (from 1 person to multinational companies) – Profit-oriented |

| Public Sector | – Under ownership of the government – Provide merit goods (goods that would be under-produced and under-consumed if left to the market forces) = e.g. healthcare and education – Also known as state-owned enterprises – Social objectives |

Profit-based Organizations

Sole Trader

| Description | An individual who is the owner of this/her own organization. The owner also runs and controls the organization and is the sole person responsible for its success and failure. |

| Ownership | Most common type of business ownership. Examples: self-employed flower organizations, plumbers, mechanics etc |

| Management | Work alone/they may employe other people to run the organization |

| Capital | Set up relatively little capital; usually built through personal savings and borrowings |

| Sources of finance | Limited sources of finance; difficult to set up finance, lack of trust from financial lenders |

| Legal status | Unincorporated; owner is treated as a single entity |

| Liability of owners | Unlimited |

| Advantages | – Few legal formalities – Receives all profit made – Higher flexibility and autonomy – Provide personalized services to customers – Enjoy financial privacy |

| Disadvantages | – Limited sources of finance – High risks – Workload and stress – Limited economies of scale – Lack of continuity – Higher production costs |

| Formation procedures | None |

Partnerships

| Description | 2/more partners carrying on the organization in common with a view of making profit |

| Ownership | Owned by two/more people, and up to 20 (vary in countries) |

| Management | Partners |

| Capital | Capital from partners |

| Sources of Finance | – savings – loans – retained profits – silent partners (investors who are not included in the business’ operations) |

| Legal Status | Unincorporated |

| Liability of owners | Unlimited |

| Advantages | – Financial strength; more owners can invest in the organization – Specialization and division of labour; shared expertise, shared workload, moral support – Financial privacy; do not have to publicize financial records – Cost-effective; each partner specializes in certain aspects of the organization |

| Disadvantages | – Lack of continuity; business has to be set up again if partner dies/leaves the business – Prolonged decision-making; more likely to take longer – Lack of harmony; disagreements and conflicts |

| Formation Procedures | – Partnership Agreements-states terms by which partnership will runs – Memorandum of Association: document outlining the crucial details of a company, e.g. its name, main purpose, registered address, amount of capital invested – Articles of Association: the internal regulations and procedures of the organization, e.g. rights, roles and power of BoD and shareholders. Administrative procedures: Annual General Meeting (AGM), processes for appointment of directors and profit distribution |

Companies/Corporations

| Description | Incorporated organizations owned by shareholders (people who have invested money in the organization/buy shares) |

| Types of Companies | 1. Private Limited Company: company that can raise share capital from friends and family, not the general public. The organization will usually have the word “Limited”/”Ltd” after its name. It has lesser shareholders, so its relatively less expensive to set up but may not be able to raise as much finance as public limited companies. 2. Public Limited Company: company that is able to advertise and sell its shares to the general public via stock exchange; once initial public offering (IPO) is done = process when the organization does floatation or first sells all/part of its organization to external investors. Usually, it carries the letter “PLC” after its name. It has more shareholders, so there is a risk of dilution of control where shareholders’ ability to control the organization weakens. It is also exposed to takeover bids from other investors. |

| Ownership | Owned by Shareholders |

| Management | Board of Directors (BoD): elected because of their skills and expertise and are in charge in the daily operations of the organization |

| Capital | Share capital |

| Sources of Finance | – Shares – Short-term and Long-term Loans – Other forms of debt capital (covered later in Unit 3: Sources of Finance) |

| Legal status | Incorporated; separate legal entity = the owner and the organization have separate legal rights, and duties (legal difference). |

| Liability of owners | Limited liability; shareholders will not lose their belongings (assets) if the organization goes bankrupt |

| Advantages | – Raise vast sums of money (permanent capital) – No interest paid but dividend instead – Easier to attract private investors (as shareholders have limited liability) – Benefit from continuity; organization can continue as a separate entity incase anything happens to the owner; does not need to cease trading – Economies of scale – Hire specialist directors to run the organization – Incentive to perform well and increase capital growth (high shares); high voting power |

| Disadvantages | – No financial security; financial records need to be uploaded – More bureaucracy; produce memorandum and articles of association – Dividends may be paid a higher proportion to Board of Directors instead of shareholders -Suffer from communication problems |

| Formation Procedures | – Memorandum of Association: document outlining the crucial details of a company, e.g. its name, main purpose, registered address, amount of capital invested – Articles of Association: the internal regulations and procedures of the organization, e.g. rights, roles and power of BoD and shareholders. Administrative procedures: Annual General Meeting (AGM), processes for appointment of directors and profit distribution |

Why Do Investors Buy Shares Within A Company

| Dividends | – Usually paid biannually – Represent a share of profits – The higher the shares, the higher the total payment |

| Capital Growth | – Shares can outperform the returns from savings – If the value of shares increase/decrease, the shareholder can sell them at a higher price to earn bigger returns/financial gain |

| Voting Power | – Higher the shares in a limited companies, higher the say in management and operation of the organization + voting power |

For Profit Social Enterprises

Cooperatives

| Description | Organization owned and controlled by a group of users for their own benefit in a socially responsible way. It can have thousands of members. All employees have a vote and contribute to decision making. |

| Types | – Financial cooperatives: credit unions = cooperative baking institution that provides banking and lending services to its members. – Housing cooperatives: own real estate. e.g. Condo projects and apartment buildings. – Worker’s cooperatives: set up, owned and organized by their employee members. e.g. production and manufacturing, cafes, printers and tourism and communication. By operating collectively, members are provided with work. – Producer cooperatives: join and support each other to process/market their products. e.g. farmer cooperative might unite to buy equipment, fertilizers and seeds collectively, by pooling their funds, thus benefitting from bulk-purchase discounts – Consumer cooperatives: owned by customers who buy goods and services for personal use. e.g. food, credit unions, child care, housing and health care cooperatives. Members get access to goods and services at lower prices than what is traditionally charged. |

| Ownership | Each member contributes equity capital and shares in the control of the firm on the basis of one-member, one-vote principle (not in proportion to his/her equity contribution) |

| Management | Managed by members |

| Capital | Each member contributes equity capital, and is paid dividend aside from their usual wages |

| Sources of Finance | – Equity capital from cooperative members – Retained profits – Long term bank loans |

| Legal Status | Incorporated; Owned and democratically controlled by its members; may take the form of companies limited by shares, partnerships/unincorporated organizations |

| Liability | Limited liability |

| Advantages | – Easy to form – Incentive to work: Employees have a key stake in the performance of the organization; increase staff motivation and labor productivity – Decision making power: cooperatives have democratic system of members having equal voting rights – Run on socially responsible principles; create social gains that can be enjoyed by the wider community – Public support: customers and third parties want these organizations to succeed |

| Disadvantages | – Difficult to attract potential shareholders whose primary interest is profit as organizations are formed to provide a service to their members rather than investment returns – Limited distribution of profits/some cooperatives may even prohibit the distribution of surplus – Slower decision making – Limited promotion opportunities: cooperatives have flatter organizational structures |

| Formation Procedures | – Dependent on the form of organization – Cooperative specific procedures |

Microfinance

| Description | Type of financial service aimed at entrepreneurs of small organizations, especially females and those on low incomes |

| Ownership | – Individuals – Banks – Credit unions – NGOs |

| Capital | – Donor funding – International financial institutions – Social investors – Government – Retained earnings |

| Legal status | Organized as incorporated for-profit entities |

| Advantages | – Accessibility: help those in poverty become financially independent – Job creation – Social well-being: applicants receiving microfinance are less likely to take their children out of school, provide better access to healthcare services |

| Disadvantages | – Immorality: unethical operation of lenders as providers profit from the poor and the unemployed – Limited finance: microfinance provide small amounts of money to borrowers given the high risk of default – Limited eligibility: not all poor individuals would qualify; microfinance providers minimize their risk by ensuring that borrowers can repay loans |

| Formation Procedures | – Requirement to obtain license from baking authorities to offer saving services |

Public-private Partnerships

| Description | When the government works together with the private sector to jointly provide certain goods or services While profit is important, it may not be the priority Collaboration between private firms and the local community Cost of using the service is borne exclusively by the users of the service, e.g. toll infrastructure will be financed by the users of the road |

| Ownership | A partnership of government and one or more private sector companies |

| Capital | – Capital investment is made by private firms on the basis of a contract with government to provide agreed services and the cost is borne wholly or in part by the government – Capital subsidy from the government in the form of one-time grant – Revenue subsidies: tax breaks/removing guranteed annual revenues for a fixed period of time |

| Legal status | Incorporated |

| Liability | Limited liability |

| Advantages | – Efficiency and innovation: private companies often have the incentive to operate more efficiently and introduce innovative solutions – Faster project implementation: private entities often have more streamlined decision-making processes compared to bureaucratic structures in the public sector – Risk sharing: shared between public and private sectors; beneficial in projects with long gestation periodshigh uncertainty |

| Disadvantages | – Cost overruns: a risk that private partners may prioritize profit over public interest, leading to financial issues that burden the government – Lack of public control: a loss of direct control for the public sector over essential services/infrastructure, potentially limiting the government’s ability to respond to public needs – Slow decision making: negotiation and management in PPPs can be time-consuming and may lead to disputes between public and private partners, causing delays and increased costs – Potential for monopoly: concentration of market power in the hands of a few private companies, leading to higher costs for the public |

| Formation Procedures | – Contract between a public sector authority and a private sector organization where the private firm provides a public service and takes the financial, technical and operations risk in the project |

Non-Profit Social Enterprises

Non-governmental organizations (NGOs)

| Description | – Private sector not-for-profit social enterprises that operate for the benefit of others rather than primarily aiming to make a profit – Private organizations that pursue activities to relieve suffering, promote the interests of the poor, protect the environment, provide basic social services/undertake community development |

| Types | – Operational NGOs: established from a given objective/purpose; tend to be involved in relief-based (e.g. humanitarian aid to help victims of war, natural disaster or famine) and community projects. e.g. Oxfam – Advocacy NGOs: take a more aggressive approach to promote/defend a cause and raise capital such as lobbying, public relations and mass demonstrations. e.g. Amnesty International |

| Ownership | Incorporated |

| Management | Trustees (people who are responsible of managing money/assets that have been left in a trust for the benefit of third parties) |

| Capital | – Individual donations (through direct main campaigns/fundraising events) – Corporate partnerships – Government support |

| Legal status | Register as limited corporations |

| Liability | Limited liability |

| Advantages | – Provide financial support for society’s welfare – Exempt from income/corporate tax – Greater influence and advocacy: registered NGOs have a stronger voice for advocacy and lobbying for policy changes and societal improvements; higher credibility when engaging with government institutions |

| Disadvantages | – Lack of profit may demotivate workers – Financial constraints: securing consistent funding from grants, donations and fundraising events can be difficult – Political and regulatory challenges: restrictive policies towards civil society organizations/changes in political landscapes can impact the operating environment for NGOs |

Charities

| Description | Non-profit social enterprises that provide voluntary support for good causes (from society’s point of view), such as protection of children, animals and the natural environment |

| Ownership | Trustees |

| Management | Group of managers and trustees similar to a limited company’s board of directors |

| Capital | Donations and grants |

| Legal status | Incorporated |

| Liability | Limited liability |

| Advantages | – Social benefits: raise funds for medical research and other socially worthy causes such as protection of children and prevention of cruelty to animals – Tax exemptions: charities are exempt from corporate tax; concessions for other taxes such as business rates and capital gains tax – Tax incentives for donors: donors can receive tax allowances on funds that are donated to charity – Limited liability: charities can register to be limited companies to protect employees and managers – Public recognition and trust: once registered, the general public and corporate donors would be in full support of charities and confident in donating money |

| Disadvantages | – Bureaucracy: need to be registered beforehand; governing bodies also place restrictions on what charities can and cannot do – Disincentive effects: lack of profit motive can demotivate workers; volunteers are not paid/paid far less than what they could earn in for-profit organizations – Charity fraud: financial activities must be reported to the government to prevent the misuse of charitable donations – Inefficiencies: owners of charities are not personally liable for any debts incurred – Limited sources of finance: reliant on donors; huge number of rival charities and limited funds from donors, need to compete for donations |

Factors That Affect The Choice of Legal Status

| Amount of Finance | – Small organizations require less capital – Big organizations require more |

| Size | – Small size, sole traders/partnerships – The larger the size, more likely to be a corporation |

| Limited Liability | – Desire to have limited liability – Protect personal possessions of owners |

| Degree of Ownership & Control | – If individuals wish to retain the control and ownership of a business may choose to stay as sole traders/private limited companies |

| Type of Business Activity | – What is the nature and scale of business activity? – e.g. mainstream aircraft and motor vehicle manufacturers rely on external sources of finances, so are likely to be formed as public limited companies |

| Change | – Evolving in size, need additional sources of finance and human resources, change legal status |

Simple Review Questions

- Distinguish between the private and public sectors.

- Compare and contrast the benefits of a partnership with those of a sole trader.

- What is the difference between private limited companies and public limited companies?

- Distinguish between for-profit and non-profit social enterprises.

- Differentiate between non-profit social enterprises and non-governmental organizations.

- State any 3 advantages and disadvantages of cooperatives.

- Distinguish between cooperatives, microfinance providers and public-private partnerships.

- State 2 disadvantages of being a non governmental organization (NGO).

- Explain the ways in which public-private partnerships (PPP) can obtain capital!

- Identify 5 types of business cooperatives!

Past Paper Review Questions

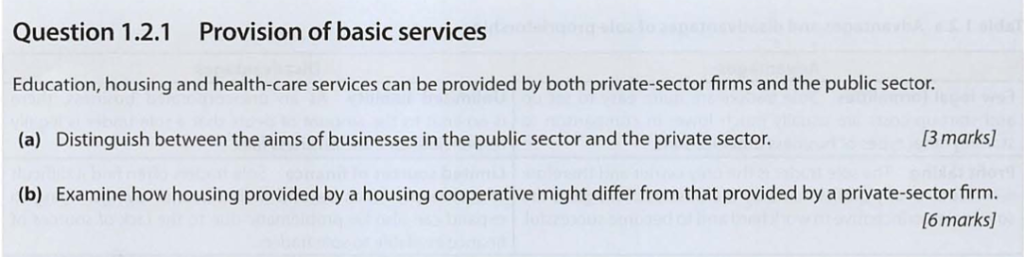

Number 1

Answer

(a) Most organizations operating in the private sector primarily aim to make a profit, e.g. private health-care

clinics or private schools will charge customers more than public hospitals or public sector schools (which provide many or all of their services free of charge due to government funding). Other aims of private sector firms include to increase market share and to become the market leader. By contrast, organizations in the public sector tend to provide a service to the general public whilst covering their operational costs.

(b) Cooperatives are for-profit social enterprises owned and run by their members (e.g. employees or

customers). The goal is to create value for their members by operating in a socially responsible way.

Cooperatives share any profits earned between their members. Hence, housing provided by housing

cooperatives will generally cater for households on lower incomes. Price will therefore be relatively low,

i.e. highly affordable housing. Thus, the quality of the housing may well be lower than in the private

sector. Te cooperative owns the property, with a proportion of the profits going back into the organization, e.g. maintenance and renovations of housing provided by the housing cooperative.

In contrast, housing provided by the private sector is based on the market forces of demand (for housing) and supply (of housing) in a particular area. The private sector is more likely to provide greater choice, e.g. different styles and sizes of houses to suit a range of preferences and budgets. Hence, the prices of the houses tend to be higher. Home buyers will generally take out a mortgage to purchase the private property, which is made available to anyone who is able and willing to purchase the home. Te buyer of the (private) property owns it.

Number 2

Answer

(a) A sole trader is someone who owns and runs his/her own organization, e.g. Cam Tran owns and operates her own flower store.

(b) The benefits to Cam Tran in operating as a sole trader include:

- It would have been quite simple for the owner to set up Flowers by Cam as there are relatively few

legalities and procedures involved. - The profits would be reaped only by Cam as there are no other owners.

- Being her own boss allows Cam to have more flexibility in decision-making, e.g. closing the store early so that she can pick up her three children from school or to attend parents’ events at the school.

- Being a small organization, Cam can keep all business transactions private, i.e. only the tax authorities need to know about her financial accounts. However, there are also costs for Cam Tran in choosing to operate as a sole trader.

- Sole proprietors have unlimited liability so this means that Cam could possibly lose her personal

possessions to finance any debts that Flowers by Cam might incur. - As a sole trader, Cam would find it difficult to secure various sources of finance, especially as she does not sell a wide range of products.

- There might also be costs related to her private circumstance, e.g. child care or the loss of time with her family due to the busy workload and stress of being a sole trader.

- A lack of continuity can occur with sole traders, especially if the owner becomes ill.

Number 3

Answer

(a) An ordinary partnership exists when there are up to 20 owners in a partnership, including any silent partners. At least one of these partners must have unlimited liability. In this case, Tonina and Keith each own 50% of the organization and both are held personally liable for any debts that EXP might incur.

(b) Advantages to Tonina and Keith running EXP as a partnership include:

- Division of labour can yield cost-saving benefts to the partnership.

- Since there are two owners, it is more likely that the restaurant can raise additional finance compared to if it had been set up as a sole proprietorship.

- The financial accounts of EXP are private to the two owners, except for the tax authorities.

Disadvantages in running the restaurant as a partnership include: - Disputes between the partners could bring the organization to a halt.

- Profits must be split 50:50.

- EXP still has restricted finance compared to limited liability companies that can raise finance through the sale of shares.

- Ordinary partnerships have unlimited liability, meaning that Keith and Tonina could lose their personal possessions if the organization falls into debt and/or collapses

(c) Smaller restaurants might find it difficult to operate and compete with larger restaurants for a few reasons, including:

- Limited sources of finance reduce the scale and scope of the firm’s operations. Tis will therefore limit EXP’s ability to benefit from economies of scale.

- Smaller organizations are statistically more prone to severe cash flow problems.

- Since they lack human and financial resources, smaller restaurants are not able to benefit from division of labour. This means a greater workload for Keith and Tonina.

- Smaller organizations have a limited customer base and therefore this restricts their proftability (and

hence their ability to survive).

(d) Small organizations can remain highly lucrative and beneficial to their owners for several reasons, including:

- The owners remain highly flexible and adaptable to change, so if the business idea or plan does not

work out then Keith and Tonina are quite flexible in making the necessary changes, e.g. it is relatively easy to transfer a small restaurant to a nail and beauty salon than for McDonald’s to change their complete operations. - Small organizations such as EXP might operate in niche markets and can become highly profitability. These markets may be untouched by larger businesses that are more concerned with mass market operations.

- There is more autonomy in decision-making for the owners of small organizations such as EXP. By contrast, managers working in large multinational companies are held accountable to their shareholders.

- There are fewer legal issues involved in the running of a small organization. Large organizations are held

accountable to a much wider range of stakeholders and their financial accounts may need to be made public. - EXP is already operating at near capacity, so stretching operations beyond their means (overtrading) might harm the firm’s reputation (late deliveries and lower quality food).

Number 4

Answer

(a) The term ‘private limited company’ means that Mars Inc. is owned by shareholders although the shares cannot be openly traded on a stock exchange. All shareholders of the organization have limited liability because the company and its owners are treated as separate legal entities.

(b) The discussion should consider the (dis)advantages of both private and public limited companies. For example:

- Private limited companies cannot raise share capital from the general public as shares are only sold to personal family members and friends. This clearly limits the finance that Mars Inc. is able to raise to compete against rivals such as Nestle and Cadbury’s (Kraft Foods).

- However, this fact also means that the directors (members of the Mars family) can maintain overall

control of the organization. For this reason, many private companies are run as family organizations and without the threat of an unwanted takeover (acquisition). - Although it is unlikely to be a real issue for Mars Inc., there are financial implications of transforming

to a public limited company, such as the cost of fotation (e.g. advertisements, prospectuses, auditors and accountants) and the need to make financial accounts available to the (increased number of) shareholders. - By keeping the company private, it can provide financial security for future generations of the Mars

family. - By contrast, Mars Inc. could raise a colossal amount of capital by selling shares on a stock exchange. With its global reputation, an initial public offer (IPO) from Mars Inc. is likely to attract major attention from private and institutional investors.

- However, there will be greater pressure from shareholders to receive dividend payments and this can be made more difficult if a non-family member is on the Board of Directors.

- For personal and historical reasons, the Mars family may be very reluctant to foat their company,

irrespective of any fnancial benefts that could be reaped.

Number 5

Answer

(a) The benefits of the public–private partnership for Hong Kong Disneyland (HKDL) include:

- With an estimated 36 000 jobs being created, there would be reduced unemployment in the economy. The benefits of reduced unemployment, such as increased consumer confidence and increased consumer spending, could be further examined.

- The globally-recognized Disneyland brand name would help to make Hong Kong a more attractive

tourist destination. This will again stimulate more spending in the economy, thereby leading to the

economic growth of Hong Kong (with an estimated net benefit of $19 billion over 40 years). - Had the partnership not taken place, then perhaps the government would have had to raise taxes in

order to have sufficient finance to own the park as a franchise or Disneyland may not have invested in Hong Kong due to the lack of financial incentives and support.

(b) Some of the arguments for using tax revenues in this case include:

- Taxpayers could benefit in the long run since the government (which is the majority stakeholder and

shareholder of HKDL) would have an alternative source of revenue (assuming HKDL makes profits, of course). - Tax revenues are a government’s largest source of revenue; any other source (e.g. borrowing or revenue from public sector corporations) is unlikely to be sufficient to finance such a huge investment project. Furthermore, borrowing would mean the government incurs interest charges on its loans.

- It would be easier to justify using tax revenues to finance this expenditure during prosperous economic times, i.e. high employment (which generates greater tax revenues) and when the government has a budget surplus (a situation when tax revenues exceed government expenditure).

However, the disadvantages of using tax revenues to pay for the HKDL theme park include: - The huge investment costs would add to the burden of Hong Kong’s taxpayers, some of whom may

never want to visit HKDL or directly benefit from its development. - Should the theme park prove to be unsuccessful, then this investment represents a huge waste of

government reserves and taxpayers’ money. - Others might question the ethics of a government having such direct involvement in the operation of a for-profit business organization.

- There might also be some environmental concerns over the construction and development of HKDL, e.g. the need to build the theme park on reclaimed land.

The viewpoints and power of key stakeholders (e.g. the Hong Kong government, Disneyland, shareholders, employees, the local community, taxpayers and potential customers) should be considered. Te extent to which the HKDL project should be funded partly with taxpayers’ money will depend on the relative importance and power of these various stakeholder groups as well as some of the aforementioned factors (such as the state of public finances).

Command Terms

References

- https://ebooks.papacambridge.com/viewer/ib/group-3-individuals-and-societiesbusiness-management-ibid-business-management-paul-hoang-third-edition-ibid-2014-pdf

- https://www.linkedin.com/pulse/what-benefits-registering-your-non-governmental-organisation/