“Financial freedom is available to those who

learn about it and work for it”

Robert Kiyosaki

Regarding IB business, finance is managing, creating, and spending funds according to its business needs with calculated planning. Finance is considered live blood for the business and helps it function smoothly.

Insufficient amount of Finance would prevent businesses from hiring employees and purchasing raw materials used to produce finished goods, and businesses would face bad debts as they are unable to pay off their needs and all the fixed costs such as rent. In other words, the higher the financial status, the easier for a business to do something to improve its performance.

NO MORE boring financial education

All of us know that lack of finance will lead to bankruptcy, but not exactly know ‘why’ and ‘how’. In addition, many young people are facing financial illiteracy.

The introduction to Finance is divided into 3 parts and this blog is the first part of the topic.

In this part, basic key terms will be thoroughly explained and reasons for failure of business in terms of finance will be provided.

Content for part 1

- Assets

- Liabilities

Assets

Assets are resources that the business owns only for the business purpose to help operate the business.

Examples – property, vehicles, real estate, furniture

There are 2 types of Assets:

- Current Asset

- Non-current Asset

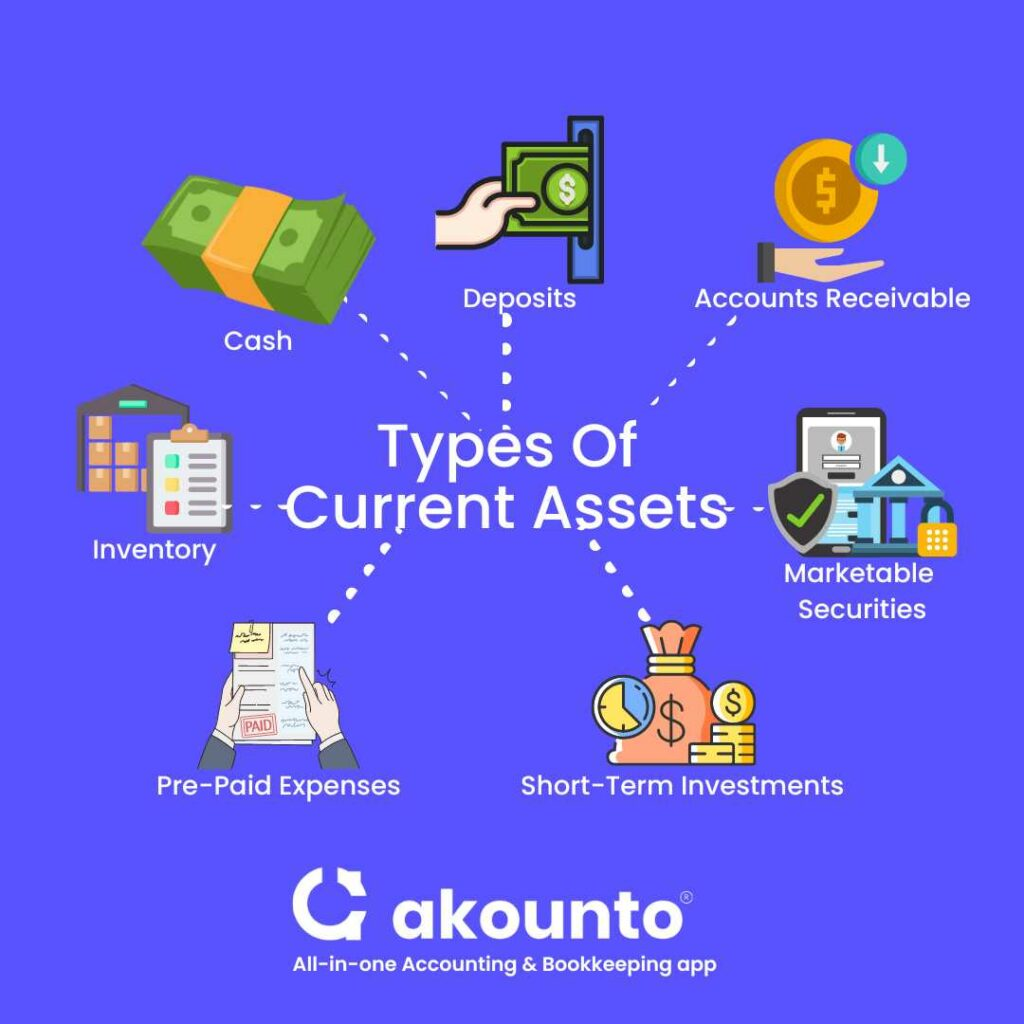

Current Asset

A Current Asset is also known as a liquid (cash) asset where the asset of the business lasts less than 12 months, usually tangible, and convertible into cash anytime the business needs.

Examples of Current Assets:

Okay…but exactly ‘why’ do we need them?

Current assets are essential because…

- They provide financial benefits towards the business which enables the business to cover immediate and short-term expenses.

- Ensures financial stability where the business can meet financial obligations and maintain positive cash flow at the same time.

- Helps the business to monitor their liquidity to assess the overall financial position, and identify trends in the market/industry that the business is pursuing, which leads to making better decisions about pricing, production, marketing, and allocating resources.

Non-Current Asset

Non-current Asset is a business’s long-term financial investment that is not intended to convert into cash in a short amount of time which usually lasts longer than 12 months.

Examples of Non-current Asset – land, buildings, machinery

I know they are essential..but I don’t know exactly ‘why’!

- Noncurrent assets such as trucks contribute to the company’s long-term value creation by providing the necessary infrastructure for ongoing operations.

- Possibly act as one of the revenue streams to generate more income for the business.

- Easier to make strategic decisions such as expanding operations, upgrading technology, or acquiring new assets which have a significant impact on the company’s future growth and competitiveness.

Liabilities

In terms of IB definition, liabilities are financial obligations, debt or claims on the business. In simple words, anything owed by the business.

Examples – tax, rent, interest rate, dividends, wage, salary

Two types of liabilities:

- Current liabilities

- Non-current liabilities

Current liabilities

‘Current’ always means short-term in business, therefore, current liabilities are also known as short-term liabilities.

Examples – Bank overdraft (overdrawing money), creditors, bills payable, short-term loans

More than just a short-term debt!

Solely relying on the owner’s personal funds or business working capital to cover all the Operational expenses such as payments to suppliers, utility bills, and employee wages would lead to a struggle to maintain business finance security.

Non-current liabilities

Non-current liabilities are business’s financial obligation or debts that last more than 12 months.

Example – loan, mortgage, lease

Significance of non-current liabilities

Businesses often require significant capital for major investments in property, machinery, and equipment.

Long-term liabilities, such as loans and bonds, provide a source of funding to undertake large-scale projects and make capital expenditures that contribute to the company’s growth and competitiveness.

That’s it for part 1 of this topic! Part 2 will be uploaded in the next post.

In part 2, capital, and expenditure will be explained for the learning content!

Want to know your experience as a business student? check this out

External sources used:

https://corporatefinanceinstitute.com/resources/accounting/non-current-assets/